Pa Tax Forgiveness Table 2025

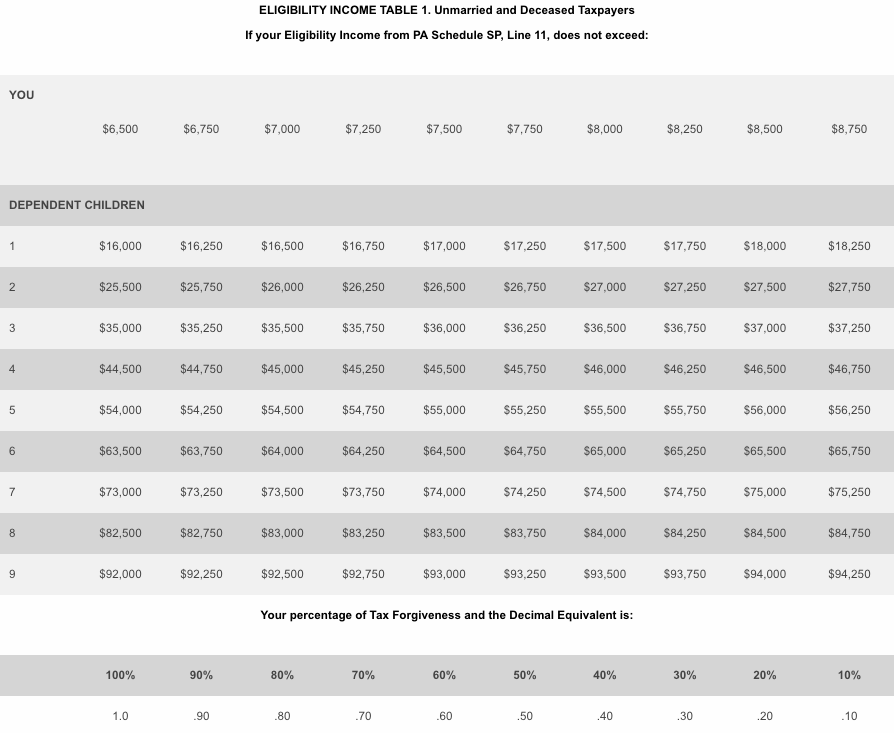

Pa Tax Forgiveness Table 2025. The 2025 tax rates and thresholds for both the pennsylvania state tax tables and federal tax tables are comprehensively integrated into the pennsylvania tax calculator for. To calculate your tax forgiveness credit, go to:

Wolf says the change will help those working in public service careers. You are subject to pennsylvania personal income tax.

Unlike Most States And The Federal Government, Pennsylvania Has A Flat Income Tax.

To learn more about the pa tax forgiveness credit, how it works, and if you qualify, read this quick guide.

Pennsylvania State Income Tax Tables In 2025.

State budget documents estimate the value of tax.

If You Don’t Qualify For Tax Relief Under The Pennsylvania Tax Forgiveness Credit, Find Out If You.

Images References :

Source: caroylnboswell.blogspot.com

Source: caroylnboswell.blogspot.com

tax rates 2022 vs 2021 Caroyln Boswell, You and/or your spouse are liable for pennsylvania. How do i calculate my my tax forgiveness credit?

Source: phoebestorey.z19.web.core.windows.net

Source: phoebestorey.z19.web.core.windows.net

Pa Registration Fees Chart, To learn more about the pa tax forgiveness credit, how it works, and if you qualify, read this quick guide. Republican & herald, pottsville, pa.

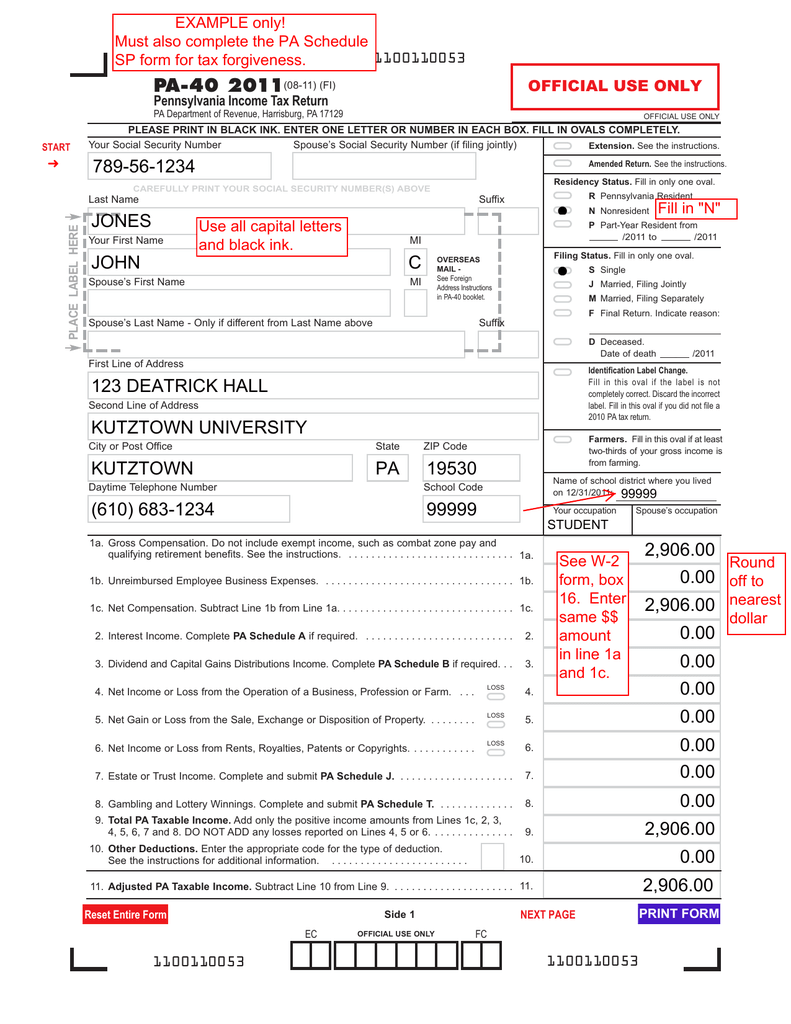

Source: studylib.net

Source: studylib.net

PA40 2011, The pennsylvania state tax calculator (pas tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. The department of education says that 5,600 borrowers in pennsylvania have been approved for forgiveness under the save plan and an estimated $45.1 million.

Source: printableformsfree.com

Source: printableformsfree.com

2025 Pa Tax Form Printable Forms Free Online, Mackenzie unveils ‘pennsylvania families tax relief’ proposals. Without a change in the law, the number of people receiving tax forgiveness is projected to keep declining.

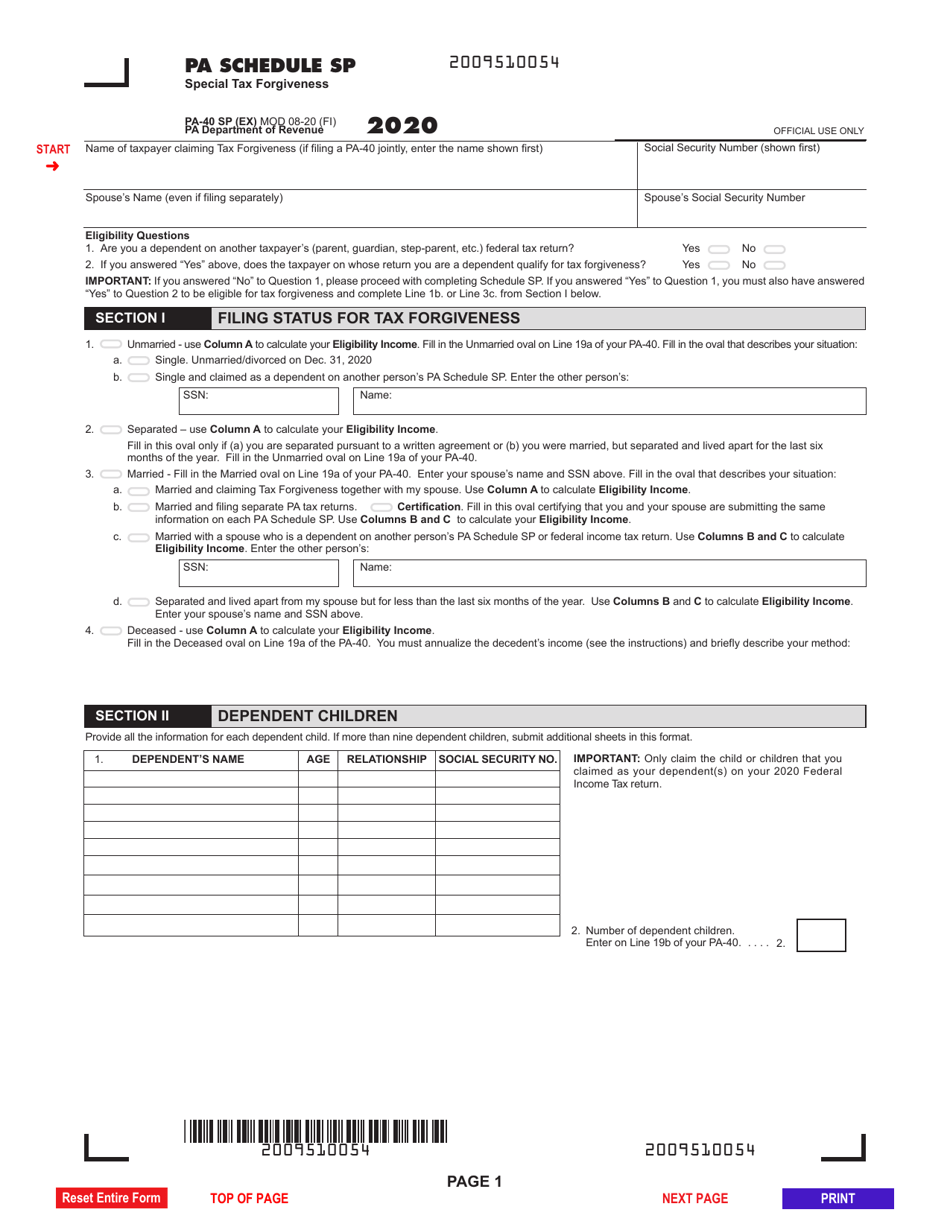

Source: www.templateroller.com

Source: www.templateroller.com

Form PA40 Schedule SP Download Fillable PDF or Fill Online Special Tax, To learn more about the pa tax forgiveness credit, how it works, and if you qualify, read this quick guide. Tom wolf said wednesday that pennsylvania student loan borrowers who will receive up to $20,000 in relief under.

Source: chimasyngkalyanbngt.blogspot.com

Source: chimasyngkalyanbngt.blogspot.com

tax credit pa Very Simple Choice Podcast Pictures Gallery, Unlike most states and the federal government, pennsylvania has a flat income tax. You and/or your spouse are liable for pennsylvania.

Source: printableformsfree.com

Source: printableformsfree.com

2025 Pa Tax Exempt Form Printable Forms Free Online, Unlike most states and the federal government, pennsylvania has a flat income tax: The pennsylvania tax forgiveness credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to pa.

Source: www.formsbirds.com

Source: www.formsbirds.com

PA40 SP 2013 Special Tax Free Download, The qualifications for the tax forgiveness credit are as follows: Eligible pennsylvanians can claim the child and dependent care enhancement tax credit when they file their pennsylvania personal income tax return.

Source: www.hipstamp.com

Source: www.hipstamp.com

A1347 BRAZIL Collection Used Central & South America Brazil, The tax tables below include the tax rates, thresholds and. The pennsylvania state tax calculator (pas tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

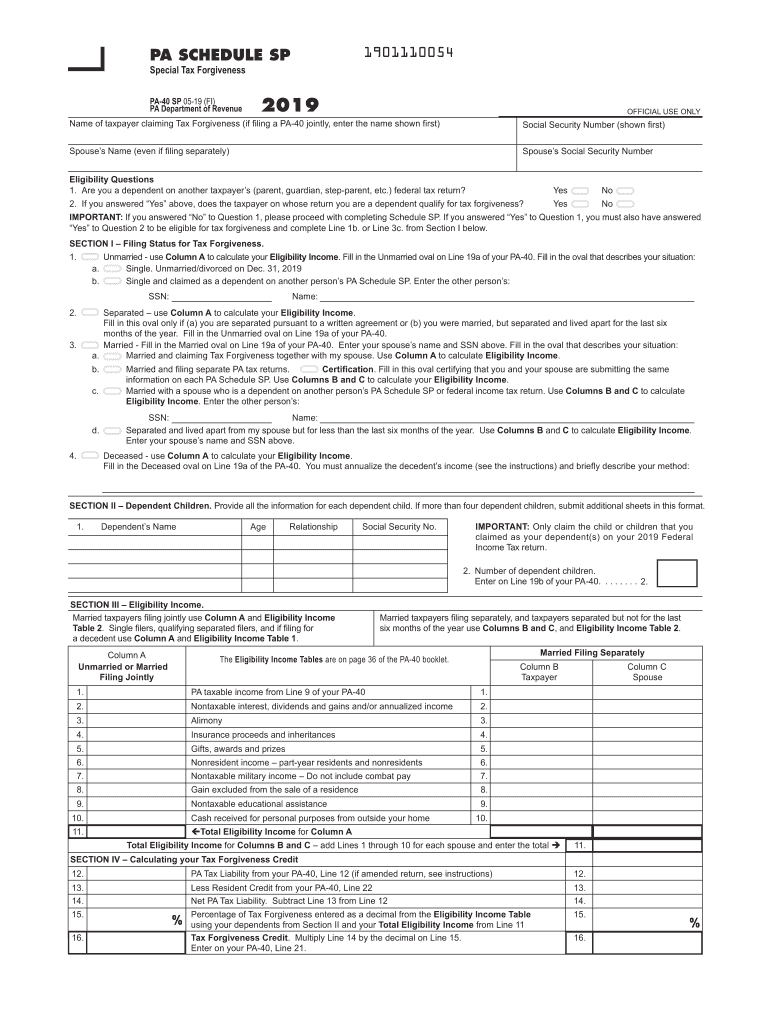

Source: www.signnow.com

Source: www.signnow.com

Sp 20192025 Form Fill Out and Sign Printable PDF Template signNow, The pennsylvania tax forgiveness credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to pa. Verifying your eligibility for tax forgiveness based on income tables and what forms to fill out if you qualify.

To Learn More About The Pa Tax Forgiveness Credit, How It Works, And If You Qualify, Read This Quick Guide.

State budget documents estimate the value of tax.

Where Do I Enter This In The Program?

Someone making $50,000 per year who doesn’t qualify for tax forgiveness.